HINT: It’s enormous!

Econ 101 – the Fundamentals of Human Nature

The market efficiently allocates and delivers goods and services in equilibrium when market buyers and sellers can freely trade for those goods and services. The free market supplies real goods and services to meet real demand.

Price is the point where buyers and sellers agree to trade money for a given good or service. Price is the consequence, the dynamic balancing point, where supply equals demand.

If the price gets too high, demand goes down until price comes down. Meanwhile, a high price will incentivize other suppliers to enter the market and compete for demand, returning prices to an equitable exchange point.

If the price gets too low, demand goes up until supply is exhausted. Meanwhile, other suppliers will enter the market to compete for demand, returning prices to an equitable exchange point.

In all cases, rational price is the consequence of voluntary decisions by free traders. Until a time machine that can see the future is built, those voluntary decisions cannot be pre-determined, regardless of how much AI horsepower is thrown at the question.

External forces upon the market – such as interventions from government force of law through price controls – cause disequilibrium and misallocation of goods and services. Misallocation means demanders want or need something and can’t get it, and, suppliers want to sell something but can’t sell it and still remain in the market.

Cost is what suppliers have to invest to produce goods and services. If price is lower than cost, suppliers leave the market. If price equals cost, suppliers don’t enter the market. In either case, price must be allowed to float to a point where demanders will still buy, and sellers have enough profit margin to incentivize them to enter or remain in the market.

Without profit, there is no market, which means nothing to sell, and nothing to buy. Obviously, when government consumes profit through taxation and appropriation, markets cease to exist.

Government price controls monkey wrench the entire system. The monolithic force of law cannot reproduce the complexity of free decisions made by millions of market participants that produce rational prices.

This is true regardless of what good or service is at stake, be it groceries, gas, electricity, health care, etc.

Price is a consequence of free trade. Free trade must exist for prices to be rational.

Politicians who promise to deliver price controls to achieve equity, should be ignored. They either don’t know what they’re talking about, or they’re maliciously trying to grab power for themselves by pandering to poorly educated voting blocks of people who don’t realize that politicians who make such promises can never deliver, and that what those politicians promise is impossible.

As you can see from the above, the market is not that difficult to understand, provided you remember the fundamentals.

Trump Harris Debate Transcript 9/10/2024

Trump’s Economic Plans

Speculation in a crisis

On the subject of masks, gloves, breathing machines, and pharmaceuticals:

Clichés of Socialiism #71

“Speculation should be outlawed.”

In 1869 John Fiske, noted American philosopher, scholar and literary critic, wrote an essay on “The Famine of 1770 in Bengal” (The Unseen World and Other Essays. Boston: Houghton Mifflin, 1876), Pointing out that a major reason for the severity of the famine was the Prevailing law prohibiting all speculation in rice. The following is excerpted from that essay.

THIS DISASTROUS piece of legislation was due to the universal prevalence of a prejudice from which so-called enlightened communities are not yet wholly free. It is even now customary to heap abuse upon those persons who in a season of scarcity, when prices are rapidly rising, buy up the “necessaries of life,” thereby still increasing for a time the cost of living. Such persons are commonly assailed with specious generalities to the effect that they are enemies of society. People whose only ideas are “moral ideas” regard them as heartless sharpers who fatten upon the misery of their fellow creatures. And it is sometimes hinted that such “practices” ought to be stopped by legislation.

Now, so far is this prejudice, which is a very old one, from being justified by facts, that, instead of being an evil, speculation in breadstuffs and other necessaries is one of the chief agencies by which in modern times and civilized countries a real famine is rendered almost impossible. This natural monopoly operates in two ways. In the first place, by raising prices, it checks consumption, putting every one on shorter allowance until the season of scarcity is over, and thus prevents the scarcity from growing into famine. In the second place, by raising prices, it stimulates importation from those localities where abundance reigns and prices are low. It thus in the long run does much to equalize the pressure of a time of dearth and diminish those extreme oscillations of prices which interfere with the even, healthy course of trade. A government which, in a season of high prices, does anything to check such speculation, acts about as sagely as the skipper of a wrecked vessel who should refuse to put his crew upon half rations.

The Capture of Antwerp

The turning point of the great Dutch Revolution, so far as it concerned the provinces which now constitute Belgium, was the famous siege and capture of Antwerp by Alexander Farnese, Duke of Parma. The siege was a long one, and the resistance obstinate, and the city would probably not have been captured if famine had not come to the assistance of the besiegers. It is interesting, therefore, to inquire what steps the civic authorities had taken to prevent such a calamity. They knew that the struggle before them was likely to be the life-and-death struggle of the Southern Netherlands; they knew that there was risk of their being surrounded so that relief from without would be impossible; they knew that their assailant was one of the most astute and unconquerable of men, by far the greatest general of the sixteenth century.

Therefore they proceeded to do just what our Republican Congress, under such circumstances, would probably have done, and just what the New York Tribune, if it had existed in those days, would have advised them to do. Finding that sundry speculators were accumulating and hoarding up provisions in anticipation of a season of high prices, they hastily decided, first of all to put a stop to such “selfish iniquity.” In their eyes the great thing to be done was to make things cheap. They therefore affxed a very low maximum price to everything which could be eaten, and prescribed severe penalties for all who should attempt to take more than the sum by law decreed. If a baker refused to sell his bread for a price which would have been adequate only in a time of great plenty, his shop was to be broken open, and his loaves distributed among the populace. The consequences of this idiotic policy were twofold.

In the first place, the enforced lowness of prices prevented any breadstuffs or other provisions from being brought into the city. It was a long time before Farnese succeeded in so blockading the Scheldt as to prevent ships laden with eatables from coming in below. Corn and preserved meats might have been hurried by thousands of tons into the beleagured city. Friendly Dutch vessels, freighted with abundance, were waiting at the mouth of the river. But all to no purpose. No merchant would expose his valuable ship, with its cargo, to the risk of being sunk by Farnese’s batteries, merely for the sake of finding a market no better than a hundred others which could be entered without incurring danger. No doubt if the merchants of Holland had followed out the maxim Vivre pour autrui, they would have braved ruin and destruction rather than behold their neighbours of Antwerp enslaved.

No doubt if they could have risen to a broad philosophic view of the future interests of the Netherlands, they would have seen that Antwerp must be saved, no matter if some of them were to lose money by it. But men do not yet sacrifice themselves for their fellows, nor do they as a rule look far beyond the present moment and its emergencies. And the business of government is to legislate for men as they are, not as it is supposed they ought to be. If provisions had brought a high price in Antwerp, they would have been carried thither. As it was, the city, by its own stupidity, blockaded itself far more effectually than Farnese could have done it.

In the second place, the enforced lowness of prices prevented any general retrenchment on the part of the citizens. Nobody felt it necessary to economize. Every one bought as much bread, and ate it as freely, as if the government by insuring its cheapness had insured its abundance. So the city lived in high spirits and in gleeful defiance of its besiegers, until all at once provisions gave out, and the government had to step in again to palliate the distress which it had wrought. It constituted itself quartermaster-general to the community, and doled out stinted rations alike to rich and poor, with that stern democratic impartiality peculiar to times of mortal peril.

But this served only, like most artificial palliatives, to lengthen out the misery. At the time of the surrender, not a loaf of bread could be obtained for love or money.

Polis’ Pandering

Publicly accessible digital ledgers using linked cryptographic identification technology, a.k.a. Blockchain, might economically be applied when the technology fits either an existing or a new application. To use the redundant and overused expression, a “use case” must exist.

Such an application would likely require:

- Participants who don’t have a shared private mechanism for trading data.

- Third party involvement in data trading relationships, or supply chains, between participants that is uneconomical.

- A need for public visibility of the substantive data content.

- Linearity: a requirement that each new addition to the chain be calculated with metadata from the previous contribution to the chain.

These are just a few factors that come to mind that might argue in favor of a blockchain application, assuming tools to implement the tech are economically available. Obviously, not every application, and perhaps not most applications for data trading, will fit blockchain technology.

But now comes Jared Polis with his platform declaration of support for blockchain – see: https://polisforcolorado.com/blockchain/

This is analogous to a declaration of support for double entry bookkeeping. Or maybe, “I like computers.”

Technology does not require a political disposition. In fact, the introduction of politics will likely harm, through needless state level encumbrances, a developing accounting technology.

I hope voters take the time to see through Polis’ panderings on this issue. He’s a big government guy who appears challenged about thinking outside of the big government box.

There seems to be an anti-capitalist bias, or distrust, of value-added intermediaries in long-established markets held by proponents in the blockchain movement. And there seems to be a corollary assumption they make that blockchain technology will pave the way for a utopian market scheme of purely economic transactions with minimal or zero profit potential through market verticals, and markets that run through entirely automated mechanisms.

If this sort of thinking were the product of scientific analysis, then fair enough, so be it. But to begin with the assumption, and then proceed to backfill reality to fit the assumption, that’s just wrong.

Utopians. They never learn.

Comparative advantage

Consider two sets of shops.

This set in Denver: http://elbertcounty.net/blog/2012/04/14/things-change/

This set in Shanghai: http://elbertcounty.net/blog/2012/06/08/on-1-block-of-fujian-road/

A place has an economic comparative advantage if its opportunity costs for providing a good or service are greater than the opportunity costs for providing that good or service in another place.

Put less obtusely, a place has a comparative advantage for a given good or service if it can be produced for less cost in that place, than in another place.

People who are allowed to trade freely with each other can utilize their comparative advantages to provide the least cost goods to each other, and thereby maximize their combined wealth.

Maximizing wealth of the people ought to be the primary goal of any government involved with regulating or controlling international trade.

Obviously, our government has not been interested in maximizing the wealth of its citizens for some time. Various social, political, and government revenue objectives have long been put first. It remains to be seen whether the Trump administration will try to remedy that situation.

But what do you do about a people who would rather get high than make things? For Trump to succeed at making America great again, Americans are going to have to want to do something more than get stoned.

Trump could help end socialism in America

Taxing imports – customs import duties – don’t do us any favors [Mr. Trump.] Notwithstanding where ownership of the foreign production resides, import duties raise prices to consumers, and send more money to be burned in the fire of federal spending. If the product is a necessity, the burden of the cost of the import duty will fall on those in need of the product. If the product is not a necessity, it will become less price competitive and possibly disappear from the market altogether.

Mr. Trump, however, is on the right track toward repatriation of American capital by lowering business taxes. But while the negative threat to levy import duties on a firm contemplating moving operations to a more economically favorable location politically appeals to class warriors, it’s really a threat to cutting off one’s nose to spite the face.

American consumers should benefit from least cost manufacturing environments.

And poorer countries know they must bootstrap themselves into the modern world, that there is no charity to bail them out from decades of socialist economic degradation. In the modern era they watched while America manufactured its way to the good life. They want to do it too, and they should.

Lower prices do not harm anyone, including Americans, and higher prices will not bring jobs back to America.

Job makers won’t leave America if the return on investment and regulatory environment remain more favorable to manufacturing in America than somewhere else. And job-making capital will return to America for the same two reasons.

These conditions should not be temporary inducements. They should be fundamental and long term features of the American business landscape. Job-making capital will come back, and will not leave in the first place, if taxes on business and income are removed, and if regulatory red tapes – at all levels of government – are eliminated.

Let’s call a spade a spade. America became socialist in the 20th century. Capital doesn’t like socialism. We can have jobs or we can have socialism. Not both.

Overt socialists like Clinton and Sanders will lament the loss of federal spending that feeds their voting blocks, and feeds their political machines. But their voting blocks would be much better fed by good paying jobs than by government handouts, price controls, subsidies, and legal shelters.

America needs to give up the socialist nightmare. Even China knows that socialism causes poverty and economic decline, though they’re not yet willing to release the communist reins of power.

Power is heroin for socialists. Cold turkey is the way to end an addiction. You don’t gradually ween from a disease. You cure it or you die from it.

We have the medicine. We know what works. We just need to quit listening to the socialists selling snake oil.

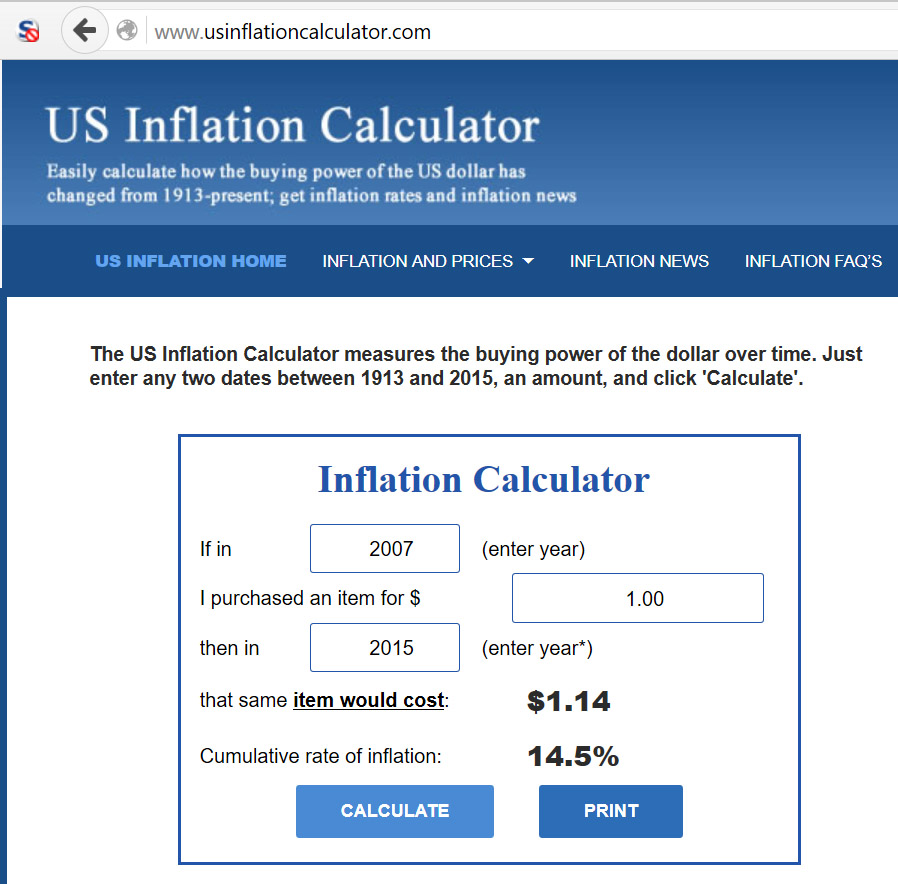

inflation under Obama

The Copernican Revolution in Economics

We’re Still Haunted by the Labor Theory of Value

Why are so many students convinced that they should receive better grades for the papers they’ve spent so much time writing? It’s not a belief about the quality of those papers; it’s a belief about the hours and hours spent working on them.

This fundamental misunderstanding about the value of labor is at the center of the Marxist critique of capitalism.

The Center of Everything

For thousands of years, humans were sure that the earth was the center of the universe and the sun revolved around it. With the advent of systematic inquiry, scientists had to develop more and more complex explanations for why their observations of the universe did not fit with that hypothesis. When Copernicus and others offered an alternative explanation that was able to explain the observed facts, and did so more clearly and concisely, the heliocentric model triumphed. The Copernican revolution changed science forever.

There is a similar story in economics. For hundreds of years, many economists believed that the value of a good depended on the cost of producing it. In particular, many subscribed to the labor theory of value, which argued that a good’s value derived from the amount of work that went into making it.

Much like the geocentric view of the universe, the labor theory of value had some superficial plausibility, as it does often seem that goods that involve more labor have more value. However, much like the story in astronomy, the theory got increasingly complicated as it tried to explain away some obvious objections. Starting in the 1870s, economics had its own version of the Copernican revolution as the subjective theory of value became the preferred explanation for the value of goods and services.

Today, the labor theory of value has only a minuscule number of adherents among professional economists, but it remains all too common in other academic disciplines when they discuss economic issues, as well as among the general public. (The labor theory of grades is, as I noted above, particularly popular among college students.)

The Specter of Karl Marx (and Adam Smith)

One reason the theory is still the implicit explanation of value in many other disciplines is because they rely on the theory’s most famous adherent for their understanding of economics: Karl Marx. Marx was hardly the only economist to hold this view, nor is the labor theory of value unique to socialists. Adam Smith believed in a somewhat weaker version of the theory as well.

Without the labor theory of value, it is not clear how much of Marx’s critique of capitalism remains valid.

For Marx, the theory was at the center of his view of the problems of capitalism. The argument that capitalism exploited workers depended crucially on the view that labor was the source of all value and that the profits of capitalists were therefore “taken” from workers who deserved it. Marx’s concept of alienation focused on the centrality of labor to making us human and the ways in which capitalism destroyed our ability to take joy in our work and control the conditions under which we created value. Without the labor theory of value, it is not clear how much of Marx’s critique of capitalism remains valid.

Part of the problem for Marx and others who accepted the theory was that there were so many seemingly obvious objections that they had to construct complex explanations to account for them. What about the value of land or other natural resources? What about great works of art that were produced with a small amount of labor but fetched extremely high prices? What about differences in individuals’ skill levels, which meant that there would be different amounts of time required to produce the same good?

The classical economists, including Marx, offered explanations for all of these apparent exceptions, but, like the increasingly complex explanations of the geocentricists, they began to feel ad hoc and left people searching for a better answer.

The Austrian Revolution

In economics, that answer came when, much like Copernicus, several economists realized that the old explanation was precisely backward. This point was clearest in the work of Carl Menger, whose Principles of Economics not only offered a new explanation for the nature of economic value but also founded the Austrian school of economics in the process.

What Menger and others argued was that value is subjective. That is, the value of a good is not determined by the physical inputs, including labor, that helped to create it. Instead, the value of a good emerges from human perceptions of its usefulness for the particular ends that people had at a particular point in time. Value is not something objective and transcendent. It is a function of the role that an object plays as a means toward the ends that are part of human purposes and plans.

Thus, according to the subjectivists, land had value not because of the labor that went into tilling it, but because people believed that it could contribute to the satisfaction of some direct want of their own (such as growing crops to eat) or that it would contribute indirectly to other ends by being used to grow crops to sell at the market. Works of art had value because many people found them to be beautiful no matter how much or how little labor went into producing them. With value being determined by human judgments of usefulness, the variations in the quality of labor posed no trouble for explaining value.

Indeed, economic value was a completely separate category from other forms of value, such as scientific value. That’s why people pay money to have someone give them a complete horoscope reading even though astrology has no scientific value whatsoever. What matters for understanding economic value is the perception of usefulness in pursuit of human purposes and plans, not some “objective” value of the good or service.

Turning Marx Upside Down

But the real Copernican revolution in economics was how the subjective theory of value related to the value of labor. Rather than seeing the value of outputs being determined by the value of the inputs like labor, the subjective theory of value showed that it’s the other way around: the value of inputs like labor were determined by the value of the outputs they helped to produce.

The high market value of well-prepared food is not the result of the value of the chef’s labor. Rather, the chef’s labor is valuable precisely because he is able to produce food that the public finds especially tasty, beautiful, or healthy.

On this view, labor gets rewarded according to its ability to produce things that others value. When you then consider the ways in which labor combining with capital enables that labor to produce goods that humans value even more, which in turn increases labor’s remuneration, Marx’s whole worldview is suddenly turned on its head. Capital does not exploit labor. Instead, it enhances labor’s value by giving labor the tools it needs to make even more of the things that humans value.

Understood correctly through the subjective theory of value, capitalism is fundamentally a communication process through which humans try to sort out how best to make use of our limited resources to satisfy our most urgent wants. Exchange and market prices are how we make our subjective perceptions of value accessible to others so they can figure out how best to provide us with the things we value most.

We Have More Work to Do

For economists, the labor theory of value holds roughly the same validity as the geocentric view of the universe. For that reason, Marx’s whole theoretical apparatus, and therefore his criticisms of capitalism, are equally questionable.

Unfortunately, many people, academics outside economics and the public alike, are simply unaware of the Copernican revolution in economics. Knocking down the labor theory of value remains a labor-intensive and valuable task.

America, listen up

I had the great fortune to make a friend in Hong Kong last April from a random meeting while waiting for a table at a restaurant. Subsequently we visited one evening over a couple bottles of wine and a duck. We began to write each other. This is from his recent letter. The lesson to America couldn’t be more clear:

“Hong Kong is a small place. What has made Hong Kong a city actually serving the world as a genuinely global financial center are: the common law system in the city, English proficiency, a free vote, a free way of life, convertibility of the currency, simple and low tax regime – there is no value added tax (VAT) for exchange of goods, and personal income tax stands at only 12%. 99% of the population are formerly refugees escaping from Chinese Communism in the mainland.”

~

Disneyfied economic fallacies

the poverty of equal outcomes

What nation does not have a “policy or practice of aggressively expanding its influence over other countries?” What nation does not have policies to expand its export markets and sell its goods into the markets of other countries? What nation does not attempt to establish trade conditions with other countries in order to obtain the best trade terms possible? What nation does not seek to maximize the comparative advantage of its own economic strengths in trading with other nations?

All nations do these things. A nation that does not have policies to foster trade in favor of its own interests eventually ceases to exist. The same rule applies in business. Altruism resulting in financial loss eventually results in bankruptcy and the cessation of business operations.

The quotation marks in the first sentence above are from Webster’s definition of hegemony. Wherever I’ve seen it employed, hegemony is a dirty word used to imply wrongful conduct on the part of a nation. Hegemony connotes a dark, if not downright evil, intent to dominate and control innocent other parties in order to serve one’s own interests. Writers use hegemony as a pejorative against a nation, a people, and a culture.

The use of hegemony, however, says more about the writer than it does any subject.

First, it indicates the writer’s belief in the existence of a collective mentality, as opposed to individual minds. Attaching a moral quality to hegemony means that a collective choice between right and wrong alternatives can be isolated such that the collective mind can be held guilty of a moral wrong.

How can men make collective choices? Not easily. It requires application of a voting infrastructure to assemble individual choices about a specific moral question into a collective outcome. Even if a vote was taken and some machinery of government acted on that vote, there is no collective entity one can hold accountable apart from the individuals who participated in the collective outcome. But it would be unjust to hold individual participants in a vote responsible for a collective outcome over which they had virtually no causal control.

Moreover, the types of grievances labelled under hegemony are never the product of a distributed decision process such as a vote. Nor are the grievances named with much specificity. Expressions of hegemony are presumed to exist when U.S. firms interact with foreign markets, because the U.S. is capitalist and oriented to the free market, and is therefore a presumptive enemy of the people represented by socialist political systems in much of the rest of the world.

Hegemony is a theoretical presumption, not a conclusion drawn from observed causation. Any theory, however, must be capable of disproof. Hegemony can no more be proved than it can be disproved, so it doesn’t even rise to the level of a theory.

As such, hegemony is an empty vessel for writers to load with any meaning or implication that suits their broader purposes. And the purposes with hegemony always involve a negative connotation. Conversely, the alleged victims of hegemony are always portrayed in the right.

In computer programming, words that function like hegemony are called variables. They get instantiated at run time by whatever they’re connected to in the surrounding code. You have to read the code to figure out the limits. The code one finds around hegemony generally involves a writers prejudice against capitalism, and against the U.S.

But when you look into the actual economic transactions with the U.S. that cross international boundaries, you find firms represented by individuals making voluntary buys and sells in what all parties perceive to be in their own best interests. They are not the outcomes of democratic processes. Each individual buyer or seller satisfies some element of the comparative advantage they represent to realize a profit on their side of the transaction. The price point they agree upon is somewhere in the middle of their two interests.

The fact that comparative advantage is unique to each place, and different from other places, sets a pre-condition for trade, and consequentially for profit by both buyers and sellers. Two parties with identical capacities have no need to trade.

Disequilibrium of comparative advantage enables trade, trade enables profit, profit enables capital formation, capital formation enables investment, investment enables the concentration of technology, technology improves efficiency, efficiency lowers unit costs, etc.

A world where everything is equal, where no comparative advantage exists, or where no one is allowed to act on their comparative advantage, is a place where nothing will change, and nothing will get better.

An equality of condition is a utopian ideal we should all hope to never achieve. Profitable trade is the natural response to economic dis-equilibrium. Socialists wouldn’t have to negatively frame international trade relationships as hegemony if socialism worked.

free speech at Elbert County public meetings

Yesterday, in a review of the recent meeting held by Commissioner Schlegel with representatives from Elbert County water districts, Bill Thomas wrote that “no public comment” was permitted, “even though it was a public meeting.”

He repeated his objection later in the piece where he said, “He [Commissioner Schlegel] did not allow questions or comments from the spectators, even though it was, in his words, ‘a public meeting.'”

Lastly, Thomas referred to the meeting as an “Open/Closed Meeting of the Water Districts,” implying that because local Leftist spectators at the meeting asked to speak and weren’t given the floor, the meeting was “open/closed” – presumably a pejorative characterization.

The Colorado Sunshine Law requires that meetings between public officials be open to the public. No requirements in state law exist for public officials to conduct forums for public speech during their public meetings.

The 1st Am. guarantees the Left a virtually unlimited right to present their ideas to the public through various publication venues, just as it does everyone else. Leftists in Elbert County generally use that right to dump on and disparage everything non-Leftists do. But there is no 1st Am. guarantee for individuals to input their free speech into meetings of public officials.

Characterizing an open meeting of public officials as tainted because Leftists were not given an opportunity to make their opposed positions heard in the meeting is simply gratuitous whining.

If Leftists put more energy into developing and publishing creative solutions to the challenges that public officials are tasked to lead, public officials might welcome their comments at public meetings.

But everyone knows what the Elbert County Left is going to say before they open their mouths. It’ll be mudballs, character assassination, impossible environmentalism, and hyperbolic images of their fantasy fears. Their cases are never realistic, just terribly frightful.

Bill Thomas is a good reporter and I appreciate his diligence. But it’s rare that he doesn’t also include a few tips of the iceberg of his Leftist agenda. Perhaps Mike Phillips requires that everyone he publishes on New Plains must also throw in some feints to the Left, an agenda tax if you will.

But the New Prairie Plains Times crowd is fiddling while Rome burns – and it’s not about the petty stuff they like to complain about – like how many miles get logged to company [county] cars, or which commissioner didn’t use his magical xray vision to foresee a water pipe break at the old courthouse, or how the Colorado Sunshine Law is really supposed to provide an open forum for the Left to hijack every meeting of public officials.

Renewable water is the holy grail of sought-after solutions in Colorado. An awareness of this problem is probably coded into the DNA of everyone born here. And considering how much rain falls throughout the state, the market can solve this problem provided people, acting in commercial organizations, are allowed to aggregate demand into economic units, and buy and sell water properties to satisfy that demand.

That’s exactly what markets do – they efficiently and fairly allocate scarce resources.

But oh wait. The Left doesn’t trust markets. The Left trusts dissent, utopian visions, social justice, and progress toward the agrarian villages of Tolkein’s Shire. The Left distrusts economic growth, technology, production, and capital accumulation. Despite hundreds of years of material advances in the quality of life throughout the world enabled by allowing individuals to accumulate capital and leverage their property in markets, Leftists persist in the erroneous belief that they can plan a better society.

After every one of the Left’s utopian experiments has increased oppression, suffering and even mass death in some cases, you’d think it would give them pause. You’d think.

Evidently the Elbert County Left have decided that renewable water in Elbert County threatens their utopia, just like oil & gas, industry, a job base for local citizens, and non-utopian elected officials do.

But the poverty and lack of opportunity we live with in this planned economic backwater they want to preserve won’t go away under the terms of the status quo. We must embrace progress in the form of real economic growth if we’re to have any chance at long-term viability in Elbert County.

Elbert County commissioners have correctly perceived the challenge and appear to be doing what they can, which involves removing the obstacle of local government and allowing the private sector to grow the economy.

This apparently frightens the Left. It shouldn’t. They stand to benefit despite themselves.

the competition

“The Singapore model was made explicit for me [Robert D. Kaplan] at the Vietnam Singapore Industrial Park, twenty miles outside Ho Chi Minh City, or Saigon as it is still called by everyone outside of government officialdom. I beheld a futuristic world of perfectly maintained and manicured right-angle streets where, in a security-controlled environment, 240 manufacturing firms from Singapore, Malaysia, Taiwan, South Korea, Europe, and the United States were producing luxury golf clubs, microchips, pharmaceuticals, high-end footwear, aerospace electronics, and so on. In the next stage of development, luxury condominiums were planned on-site for the foreign workers who will live and work here. An American plant manager at the park told me that his company chose Vietnam for its high-tech operation through a process of elimination: “We needed low labor costs. We had no desire to locate in Eastern Europe or Africa [which didn’t have the Asian work ethic]. In China wages are already starting to rise. Indonesia and Malaysia are Muslim, and that scares us away. Thailand has lately become unstable. So Vietnam loomed for us: it’s like China was two decades ago, on the verge of a boom.” He added: “We give our employees in Vietnam standardized intelligence tests. They score higher than our employees in the U.S.”

This is an example of international manufacturing competition today – intelligent employees with a positive work ethic producing high quality products in predictable and efficient modern factories. This is the standard of production that America must retool to meet in order to successfully compete for business in the world market.

Protecting American companies from international competition through import duties on products, high tariffs, and anti-dumping laws, lowers the bar for American domestic manufacturing, raises prices to American consumers, and induces the obsolescence of American manufacturing capacity. Remember British Leyland? A memory is all that remains of it.

The choice is clear.

Americans can continue to protect themselves, stay on the path toward manufacturing extinction, and become a client state to the various countries in the world who produce goods.

Or Americans can disassemble the protectionist devices shielding our markets, undo the congressional influence-buying and political-patronage system of Customs import duties, engage in international manufacturing on competitive terms that will attract capital to America, and once again enjoy the benefits that follow from a growing economy.

We can either produce, or get used to enslavement.

the problem

Elbert County with its depressed local economy, high unemployment, anti-business regulations, and anti-growth planning, has proven to be a failed state. Without subsidies and grants for schools, roads, and county services, Elbert County would shut down tomorrow. Tweaks to this or that county procedure or budget line item, regardless of motivation from political party or constituency, won’t fix Elbert County.

The only necessary public function Elbert County should be engaged in is road maintenance. And even if the county focused only on that, it would still be challenged to produce a popular outcome. Emergency services should stand or fall on their own merits as separate agencies. As for the rest of it, the county hosts a Kabuki shadow play that redistributes wealth, enables failure, blocks free people from securing the fruits of the American dream, and crowds out competition.

Until the private sector of Elbert County rises up and produces something that people elsewhere want, in other words, until Elbert County citizens engage with the free market outside of the county borders and successfully bring a stream of wealth and capital into the county, Elbert County will remain a failed state.

Today, and unless something drastically changes, for the foreseeable future, Elbert County citizens practice a form of voluntary servitude that can only consume them. Unless we add something of value to the supply chain, the future here remains bleak.

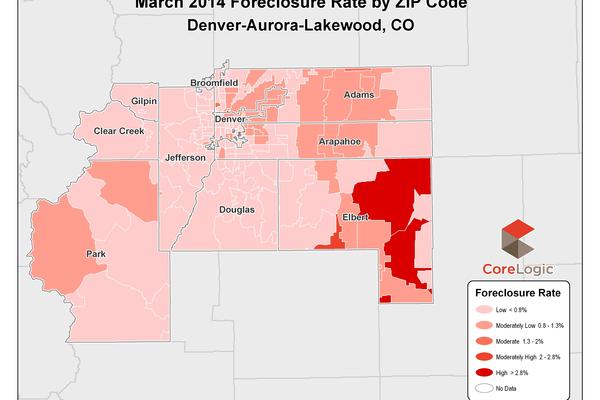

A map showing the foreclosure rate in 10 Colorado counties. Elbert county has the highest foreclosure rate (over 2.8 percent), while Clear Creek, Gilpin and Douglas plug in the lowest rates (under 0.8 percent). Denver Business Journal

A fair trade

Will trade tax vote for zoning repeal.

If the BOCC repeals land use zoning regulations, I’ll vote for their tax increases.

If Elbert County wants to take more money from citizens, citizens should be free to earn money in Elbert County.

B_Imperial

RE: (land use zoning regulations)

Please click on the links below to download various Regulations & Plans:

- Elbert County Master Plan

- Elbert County Housing Section Final

- Elbert County Zoning Regulations pdf files are broken into two parts – please see below

- Elbert County Zoning Regulations Part I

- Elbert County Zoning Regulations Part II

- Elbert County Subdivision Regulations

- Guidelines and Regulations for Areas and Activities of State Interest

LAND USE APPLICATIONS

(Please refer to the Section identified on each application in either the Subdivision or Zoning Regulations for more information.)Please click on the links below to download various Applications:

- Land Use/Zoning Districts

- Land Use Application Form

- Application Agreement Form

- Disclosure Letter

- Fee Schedule 09

Administrative Applications

(All administrative applicants shall meet or talk with Community and Development Services Office staff prior to application submittal to determine if application can be handled administratively.)Non-Administrative Land Use Applications

(All applicants shall meet or talk with Community and Development Staff to find out about the required Pre-Application Meeting, its submittal requirements and scheduling prior to formal application submittal.)

- Temporary Use Permit

- Special Use Permit

- Plat Amendment

- Variance

- Concept Plan

- 1041 Application (Application available in Community and Development Services)

- Rezone

- Planned Unit Development

- Preliminary Plat

- Final Plat

- Water Supply Information (Please include with all applications)

Please contact the Community and Development Services Office if you have questions.

C-1 Bond language

Note where the C-1 Board increased the cost estimates used to justify the Bond.

More importantly, note how the ballot language – which will become the controlling law in this deal – clouds the source & use control of funding. The Board combined project estimates into ballot groupings, and then put everything under the funds flow from the BEST grants. Since the C-1 Board had analyzed the ballot language for some time before tonight -video- one could conclude that rigid internal control of Bond funds flow wasn’t an objective.

Also, the repayment cost of the debt of $3.8M is the real cost to the taxpayers. Focusing on the bond value as the measure of the impact of the debt, disguises the real cost of all the chosen projects. You need to add 40% to each project to estimate its indebted real cost. [Read more…]

Elbert County in a state of nature

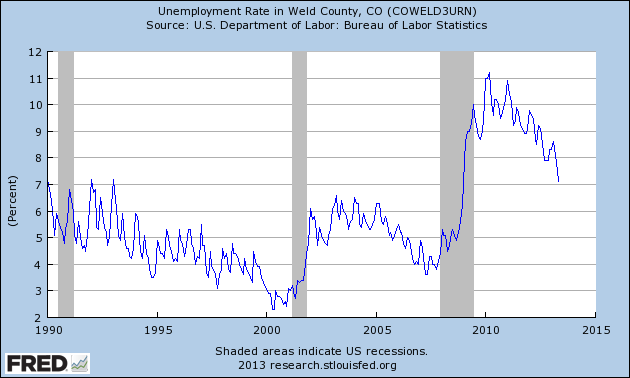

Left has myths about Weld

Assessed valuation is a gusher in Weld County

Property values hit $7.1 billion, among richest in state

Weld County’s assessed value soars – Assessed value from 2001 to 2013 (in $billion). *This figure from Weld Assessor Christopher Woodruff is preliminary. Source: Weld County Assessor’s Office |

Steve Lynn

Assessed property values in Weld County, long known for its affordable, rural lifestyle, have reached $7.1 billion this year, putting it on par with the wealthiest counties in metro Denver.

The increase in value is largely attributable to oil and natural-gas production, which makes up 55 percent of the county’s total assessed value, Weld Assessor Christopher Woodruff said.

“In terms of what’s driving the dollars, it’s oil and gas,” Woodruff said. “The other classes of property are not big enough or don’t change enough to make enough difference into the actual tax dollars that are paid.”

The largest increase came from the Wattenberg field, the area extending from north of Denver well into Weld County, which marks the sweet spot of Weld’s oil and gas drilling boom.

Assessed value for 2013 determines the amount of tax revenue the county’s more than 300 tax districts collect next year. The assessed-value figures are preliminary, but could increase in coming months. The county will certify this year’s values for the first time in August, with a final certification coming in December.

Last year’s assessed value in Weld reached $6.5 billion, netting $454 million in revenue for tax districts, including the county itself, junior colleges, schools, fire and water districts and others. Property tax revenue increased $71 million from the $383 million collected the prior year.

In 2012, oil and gas accounted for 52 percent of assessed value. Noble Energy Inc. and Anadarko Petroleum Corp., two of the largest oil and natural-gas companies in the region, paid the county $148 million in 2012 property taxes, nearly one third of all the county’s tax revenue.

This year, agricultural assessed value rose 18 percent, but it only makes up 2 percent of total assessed value, Woodruff said.

In April, Weld was ranked No. 4 in total estimated assessed value at $6.8 billion, behind Denver, Arapahoe and Jefferson counties, according to a study from the state Department of Local Affairs’ Division of Property Taxation. Denver County ranked No. 1 with $11.3 billion in assessed value, well ahead of the others.

Of the top-ranked counties, however, Weld saw the largest percentage increase in assessed value of 4.9 percent.

Based on the new $7.1 billion figure, Weld’s assessed value growth rises to 9.2 percent.

“Some counties, such as Weld County, are growing dramatically,” said JoAnn Groff, the state property tax administrator, who also attributed the increase to oil and gas activity.

By contrast, Larimer County’s 2013 assessed value was estimated at $4.19 billion, up slightly from $4.13 billion in 2012.

The influx of tax revenue has helped keep Weld’s mill levy low. In 2001, Weld’s mill levy was 20.599; by 2006 it was down to 16.804, where it has remained.

Bill Jerke, a farmer and oil and gas consultant as well as a former state representative and Weld County commissioner, said the low tax rates have promoted economic prosperity.

“The overall wealth keeps going up, and as a result, the tax rate goes down,” he said. “It winds up making us more attractive. … You can live in a home or have a business in Weld County and have the property taxes be quite a bit cheaper than they would be across the county line.

“It’s a continuation of the wonders oil and gas have been bringing us.”

Foreclosure filings drop 54 percent in Weld County

Foreclosure filings were down 50.5 percent in Colorado metro counties during May 2013, falling year over year to the lowest level recorded during May in any year since the Colorado Division of Housing began collecting monthly totals in 2007. In Weld County, foreclosure filings dropped 54.7 percent from 139 to 63. Foreclosure auction sales in Colorado’s metropolitan counties were down 25.4 percent in May this year compared to May of last year, falling from 965 to 720, according to a report released Wednesday by the Colorado Division of Housing. Over the same period, foreclosure filings dropped from 2,249 to 1,113.