Assessed valuation is a gusher in Weld County

Property values hit $7.1 billion, among richest in state

Weld County’s assessed value soars – Assessed value from 2001 to 2013 (in $billion). *This figure from Weld Assessor Christopher Woodruff is preliminary. Source: Weld County Assessor’s Office |

Steve Lynn

Assessed property values in Weld County, long known for its affordable, rural lifestyle, have reached $7.1 billion this year, putting it on par with the wealthiest counties in metro Denver.

The increase in value is largely attributable to oil and natural-gas production, which makes up 55 percent of the county’s total assessed value, Weld Assessor Christopher Woodruff said.

“In terms of what’s driving the dollars, it’s oil and gas,” Woodruff said. “The other classes of property are not big enough or don’t change enough to make enough difference into the actual tax dollars that are paid.”

The largest increase came from the Wattenberg field, the area extending from north of Denver well into Weld County, which marks the sweet spot of Weld’s oil and gas drilling boom.

Assessed value for 2013 determines the amount of tax revenue the county’s more than 300 tax districts collect next year. The assessed-value figures are preliminary, but could increase in coming months. The county will certify this year’s values for the first time in August, with a final certification coming in December.

Last year’s assessed value in Weld reached $6.5 billion, netting $454 million in revenue for tax districts, including the county itself, junior colleges, schools, fire and water districts and others. Property tax revenue increased $71 million from the $383 million collected the prior year.

In 2012, oil and gas accounted for 52 percent of assessed value. Noble Energy Inc. and Anadarko Petroleum Corp., two of the largest oil and natural-gas companies in the region, paid the county $148 million in 2012 property taxes, nearly one third of all the county’s tax revenue.

This year, agricultural assessed value rose 18 percent, but it only makes up 2 percent of total assessed value, Woodruff said.

In April, Weld was ranked No. 4 in total estimated assessed value at $6.8 billion, behind Denver, Arapahoe and Jefferson counties, according to a study from the state Department of Local Affairs’ Division of Property Taxation. Denver County ranked No. 1 with $11.3 billion in assessed value, well ahead of the others.

Of the top-ranked counties, however, Weld saw the largest percentage increase in assessed value of 4.9 percent.

Based on the new $7.1 billion figure, Weld’s assessed value growth rises to 9.2 percent.

“Some counties, such as Weld County, are growing dramatically,” said JoAnn Groff, the state property tax administrator, who also attributed the increase to oil and gas activity.

By contrast, Larimer County’s 2013 assessed value was estimated at $4.19 billion, up slightly from $4.13 billion in 2012.

The influx of tax revenue has helped keep Weld’s mill levy low. In 2001, Weld’s mill levy was 20.599; by 2006 it was down to 16.804, where it has remained.

Bill Jerke, a farmer and oil and gas consultant as well as a former state representative and Weld County commissioner, said the low tax rates have promoted economic prosperity.

“The overall wealth keeps going up, and as a result, the tax rate goes down,” he said. “It winds up making us more attractive. … You can live in a home or have a business in Weld County and have the property taxes be quite a bit cheaper than they would be across the county line.

“It’s a continuation of the wonders oil and gas have been bringing us.”

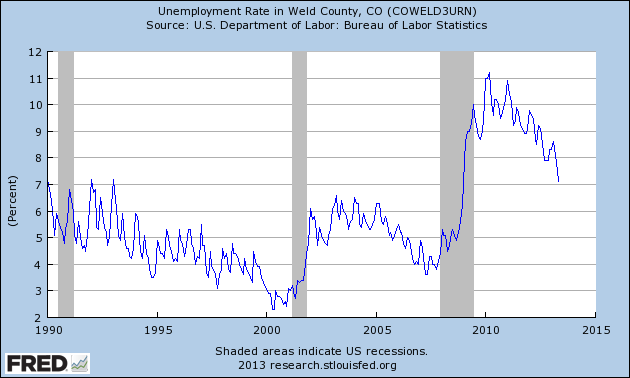

Foreclosure filings drop 54 percent in Weld County

Foreclosure filings were down 50.5 percent in Colorado metro counties during May 2013, falling year over year to the lowest level recorded during May in any year since the Colorado Division of Housing began collecting monthly totals in 2007. In Weld County, foreclosure filings dropped 54.7 percent from 139 to 63. Foreclosure auction sales in Colorado’s metropolitan counties were down 25.4 percent in May this year compared to May of last year, falling from 965 to 720, according to a report released Wednesday by the Colorado Division of Housing. Over the same period, foreclosure filings dropped from 2,249 to 1,113.